As the 2024 U.S. election draws near, domestic manufacturers, wholesalers, and distributors face a critical moment. The outcome of the election could make or break these industries, which depend heavily on the health of the American middle class. For decades, the U.S. middle class has been the engine of economic growth, driving demand for goods and services. But with rising inflation, wage stagnation, and shifting trade policies, their purchasing power is under pressure.

This article explores the vital connection between middle-class economic success and the fortunes of domestic suppliers, producers, and distributors. It delves into the key issues at stake in the upcoming election — regulation, tariffs, immigration, the strength of the dollar, logistics disruptions, and, most importantly, middle-class wages. At the heart of the matter lies a simple truth: without a thriving middle class, domestic suppliers cannot prosper. The unique thing about this election is that we can safely compare the Trump administration with the Biden/Harris administration and see where we land.

The Power of the American Middle Class: Why Their Success Matters

The U.S. middle class is the most powerful consumer group in the world, accounting for approximately 70% of U.S. GDP. This demographic doesn’t just buy goods and services — they drive demand that sustains entire industries. From housing to automobiles, electronics to consumer goods, the purchasing power of the middle class fuels growth for manufacturers, wholesalers, and distributors. Their economic success — or failure — directly influences the performance of domestic suppliers.

Higher wages, adjusted for inflation, translate into more disposable income, which leads to increased consumer spending. In contrast, stagnant or declining real wages erode the purchasing power of middle-class Americans, slowing down demand for products. Without robust middle-class spending, suppliers face reduced orders, lower production volumes, and shrinking profits. For these industries, the prosperity of the middle class isn’t just important — it’s critical for their survival.

Inflation and the Impact of Energy Policy and Federal Spending

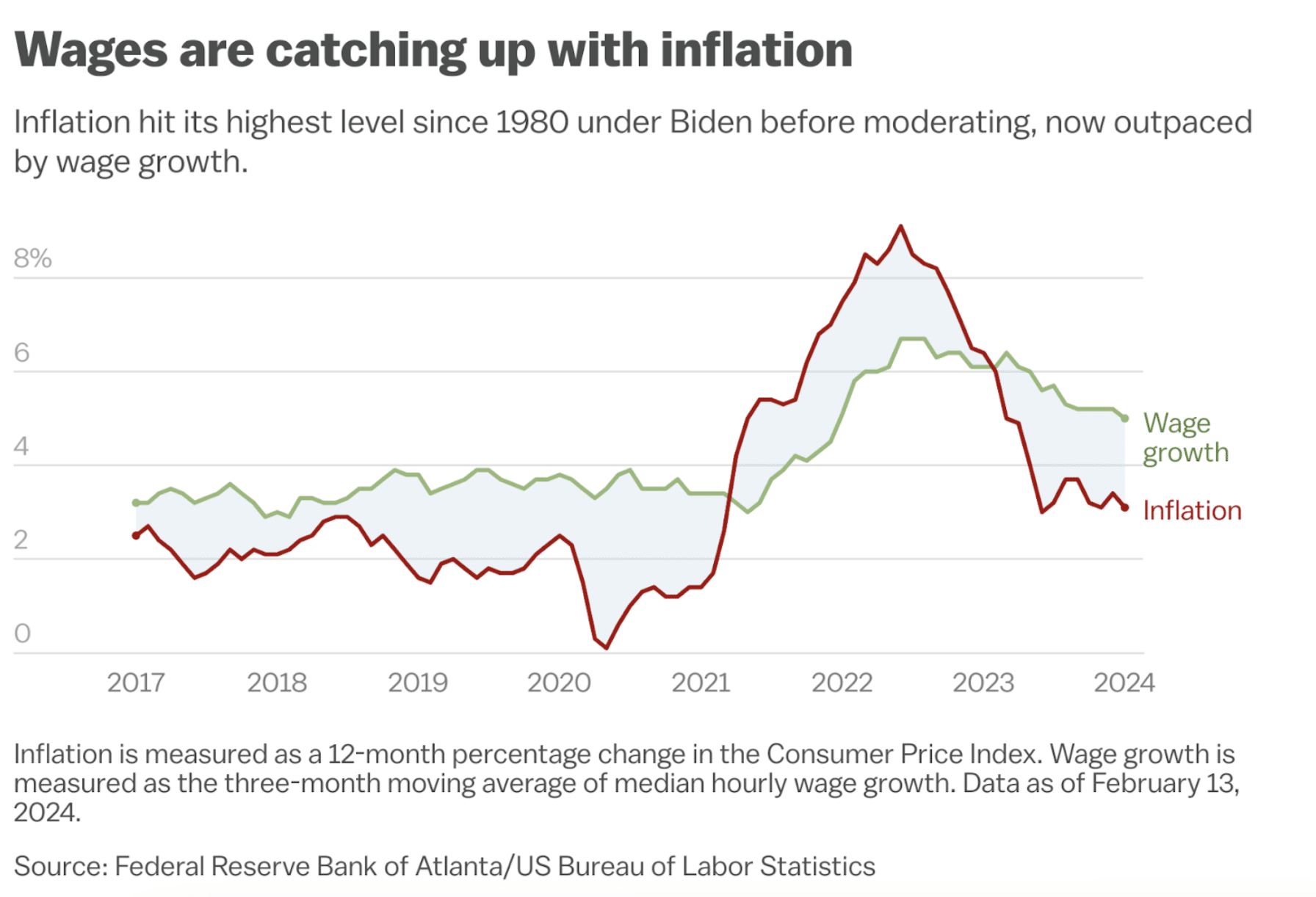

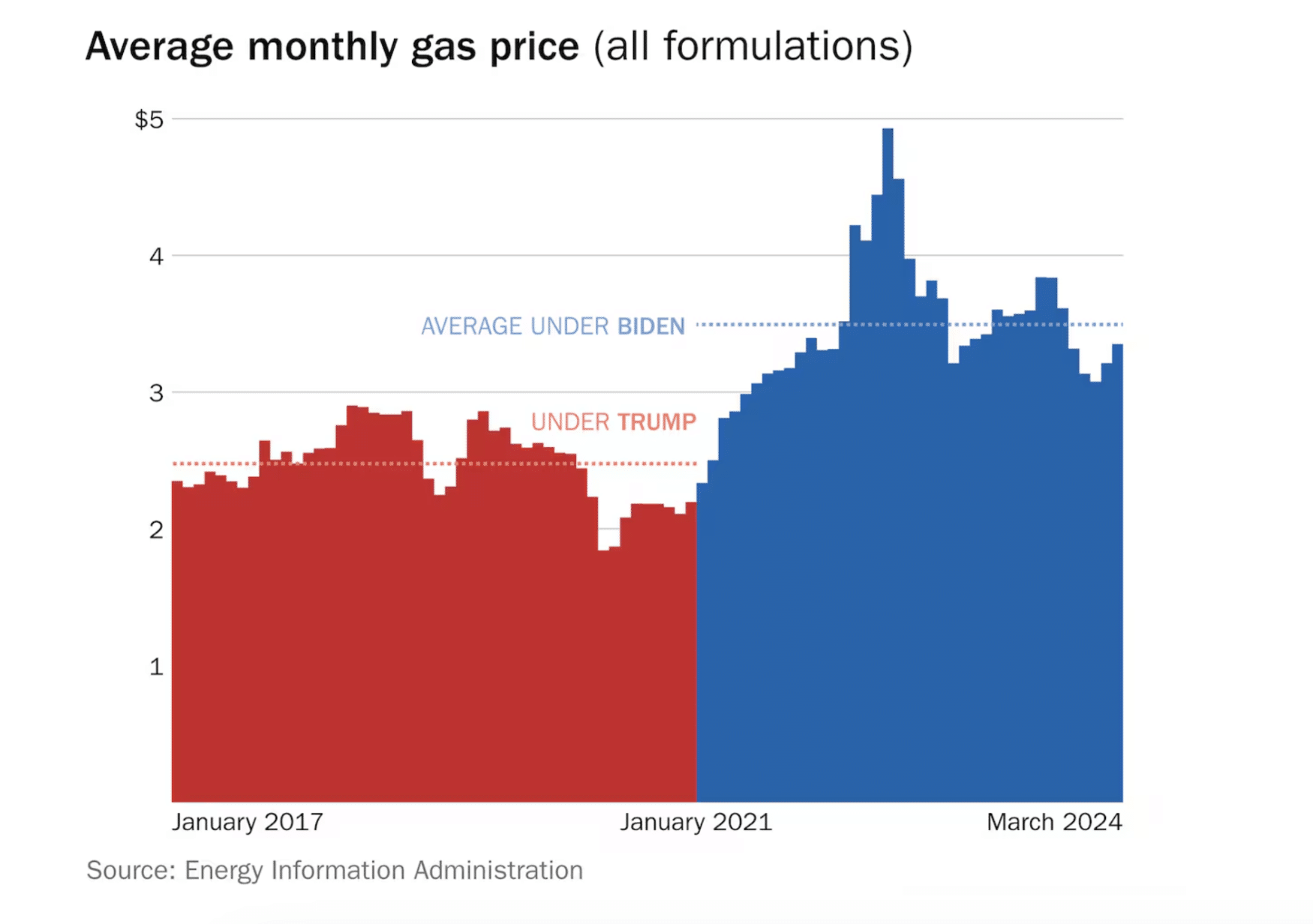

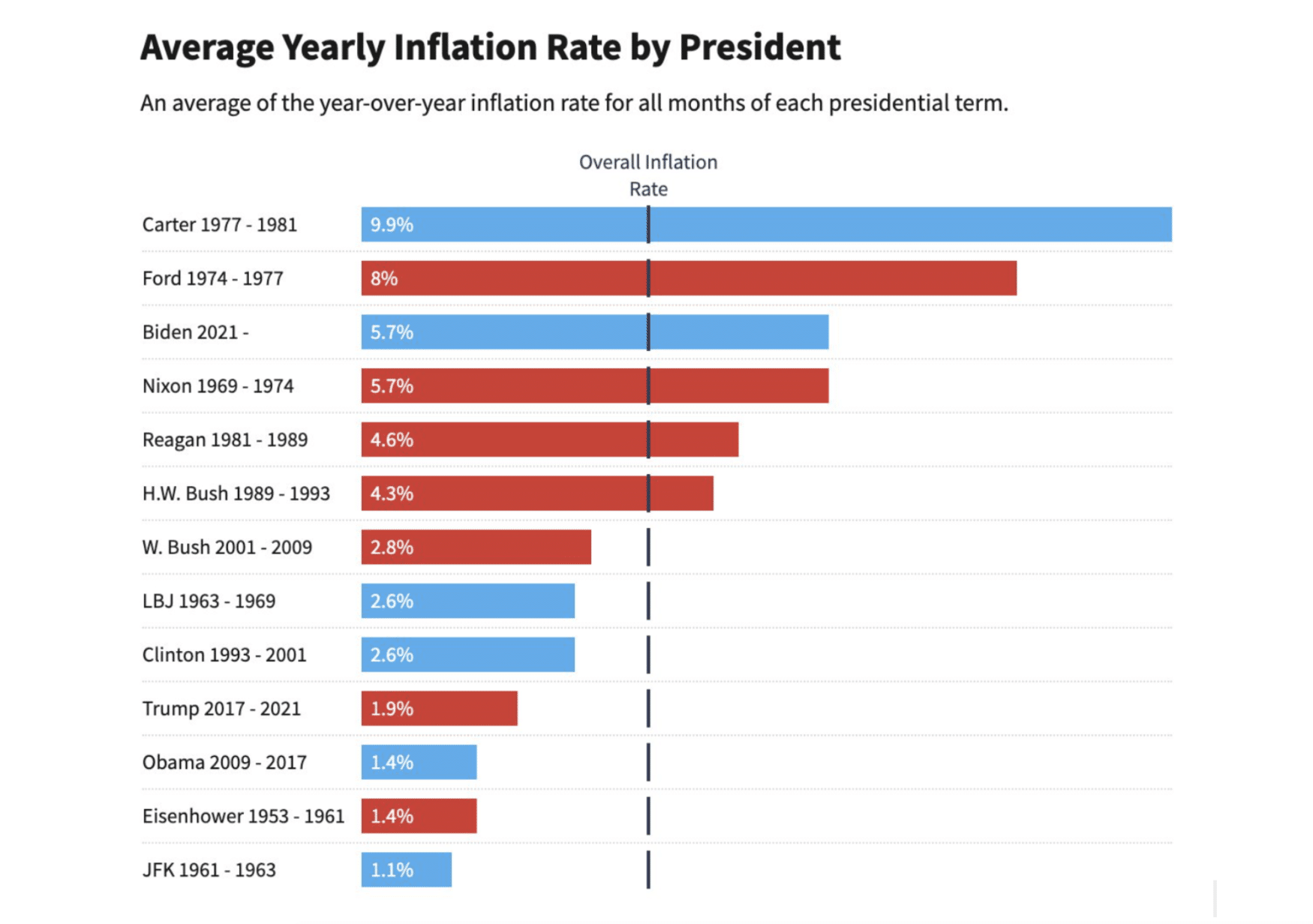

A significant challenge facing the middle class has been the inflationary effects stemming from a 2021 reduction in domestic energy production and substantial federal spending. In 2022, inflation surged to its highest level since the 1970s, reaching 9%, effectively wiping out any wage gains made by the middle class and, in many cases, decreasing real wages. This spike in inflation has severely hurt purchasing power, leading to a decline in the quality of life for many Americans.

The reduction in domestic energy production has contributed to rising energy costs, further straining household budgets. Simultaneously, massive federal spending, passed through Congress, has injected money into the economy but has also stoked inflationary pressures.

As prices for essentials like food, gas, and housing have skyrocketed, middle-class families find themselves increasingly squeezed. This erosion of purchasing power has critical implications for GDP growth when adjusted for inflation, as consumer spending contracts under the weight of rising costs.

Regulation: Balancing Business Costs with Worker Protections

The Biden/Harris administration has placed a strong emphasis on regulatory measures that focus on environmental standards, labour rights, and workplace protections. While these regulations have increased compliance costs for businesses, they also aim to create a more sustainable and fair economic environment. For suppliers and manufacturers, adhering to these regulations means higher operational costs, but it can also foster long-term stability and consumer trust.

In contrast, former President Donald Trump’s deregulatory approach during his term reduced these constraints, lowering costs for businesses and providing short-term financial relief. However, without regulatory safeguards, industries risked long-term environmental and social backlash, which could harm their reputations with increasingly conscientious consumers. As voters weigh their options, the future of regulatory policy could either increase operational costs or create a more predictable, sustainable environment for manufacturers.

Tariffs: Inflationary Pressures on Imported Goods

Tariffs have been a defining feature of both administrations, but their impact on domestic suppliers is mixed. Trump’s protectionist tariff policies, especially his trade war with China, aimed to shield U.S. industries from foreign competition. However, the reality for many domestic manufacturers was an increase in the cost of imported materials, which in turn drove up production costs. These costs were passed on to consumers, contributing to inflation and eroding the purchasing power of the middle class.

Biden, while maintaining some of these tariffs, has sought to ease trade tensions and work more collaboratively with global partners. But without meaningful changes, tariffs will continue to exert inflationary pressure, making products more expensive and further straining the budgets of middle-class consumers.

Middle-Class Wages: The Foundation of Domestic Economic Success

At the core of this discussion is the reality that the middle class is the ultimate driver of demand for domestic suppliers. Without rising wages adjusted for inflation, the purchasing power of this critical consumer group diminishes. While Trump focused on tax cuts and deregulation to stimulate business growth, wage stagnation among the middle class limited their ability to increase spending. In contrast, Biden has pushed for wage increases and stronger labour protections, but inflation has eroded these gains, leaving many Americans with less real purchasing power.

For domestic suppliers, the message is clear: a strong, thriving middle class is essential for economic success. Higher real wages lead to increased consumer spending, which drives demand for goods and services. This demand, in turn, supports production and distribution across industries, creating a virtuous cycle of economic growth. Without robust wage growth, however, domestic suppliers face the risk of declining orders and shrinking revenues.

Conclusion: The Election’s High Stakes for Domestic Suppliers

The upcoming U.S. election could be a pivotal moment for domestic manufacturers, wholesalers, and distributors. The policies of the next administration will directly impact the economic success of the American middle class — the consumer group that drives demand for their products. For these industries, the equation is simple: without a thriving, well-compensated middle class, demand will falter, leading to lower production volumes and reduced profits.

The choice facing voters — and businesses — is whether to support policies that emphasize wage growth, infrastructure investments, and a stronger social safety net, or policies that focus on deregulation, lower taxes, and protectionism. Both approaches have their merits, but for domestic suppliers, the prosperity of the middle class is the linchpin of their future success.

As the election approaches, the stakes for manufacturers, wholesalers, and distributors could not be higher. The health of the U.S. economy — and the success of these industries — will depend on the next administration’s ability to empower the middle class and ensure that wage growth outpaces inflation. Only then can domestic suppliers thrive in a rapidly changing global marketplace.