Smarter Payments, Stronger Business

Wholesalers and suppliers across industries are using PencilPay to streamline payments, reduce risk, and improve cash flow—making it easier than ever to grow their business.

Our Customer Stories

APTC

APTC, a waterproofing supplier in Australia, streamlined payments with PencilPay, automating billing and securing credit card storage. This cut debtor days by 57%, saved 1.5 staff hours daily, and improved cash flow and customer experience.

The Bean Cartel

The Bean Cartel, A coffee roaster from Melbourne, streamlined billing and cash flow with PencilPay, automating credit applications, supply agreements, and payments. This reduced overdue invoices, saved admin time, and ensured steady revenue growth.

Sciclunas

Scicluna’s, a fresh produce supplier, needed to manage cash flow due to high volumes of customers on payment terms. Learn how they streamlined onboarding, credit management, and payments—reducing receivables by half and debtor days by 35%.

Alti Lighting

Alti Lighting, is a Western Australian-based lighting supplier, streamlined deposit processing with PencilPay, reducing payment errors and automating reconciliation. This saved time, improved accuracy, and accelerated cash flow.

Cloud Cuckoo Cocktails

Cloud Cuckoo Cocktails, a Melbourne-based beverage supplier, transformed credit processing and accounts receivable with PencilPay. Automating payments reduced debtor days, eliminated late payments, and ensured steady cash flow.

P10 Foods

P10 Foods, a US-based food distributor, automated customer onboarding and payments with PencilPay, reducing overdue invoices and streamlining collections. This improved cash flow, saved admin time, and strengthened financial stability.

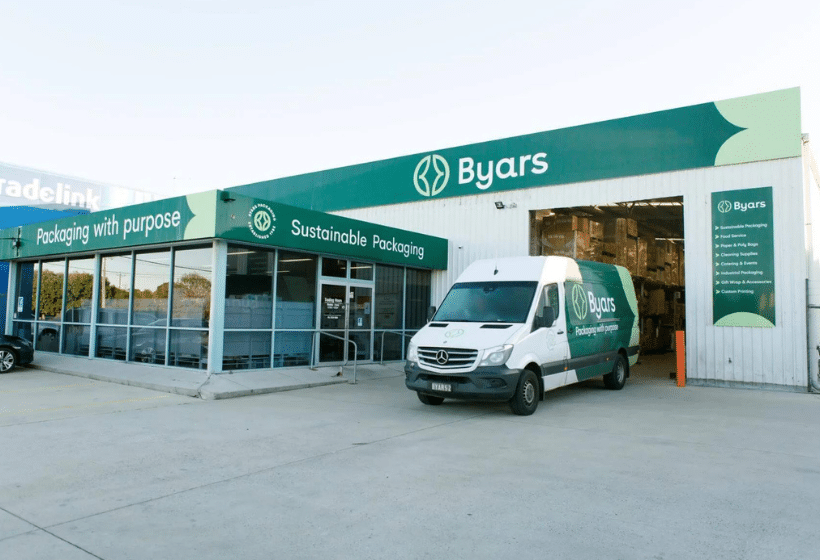

Byars Packaging

Byars Packaging, a hospitality and packaging supplier from Geelong, streamlined payments and secured customer data with PencilPay. Automating transactions and integrating with Xero and Cin7 saved admin time, improved cash flow, and ensured timely payments.

One Drop Brewing

One Drop Brewing Co, a craft brewery in Botan, Australia, automated payments and customer onboarding with PencilPay. By streamlining direct debits and wholesale applications, they reduced their overdue invoices, saved admin time, and improved cash flow.

Take control of your wholesale accounts today!

- 30-day free trial

- Support 24/7

- User friendly

FAQ's

We know that transitioning to a new system can raise some questions, and we’re here to provide clarity.

PencilPay is used by your accounts, sales, and operations teams, seamlessly integrated with your Accounting, ERP, or Inventory Software.

Automated account onboarding with a stored billing method boosts sign-ups, ensures on-time payments, cuts debtor days, reduces total debtors, and enhances cash flow. The more you add, the better your cashflow.

By automating your application process, you’ll onboard and process customers faster, especially with the added benefit of storing billing methods. The more customers you have signed up, the more on-time payments you receive. This naturally reduces average debtor days and total debtors, ultimately improving your cash flow.

Pencil provides comprehensive support for setting up and managing customers who purchase on account. Our services include one-on-one support, free training sessions via Zoom, phone assistance, and live chat support. Additionally, we offer industry-specialist terms and conditions and a structured approach to managing different customer types and risk profiles.

We can assist you in setting up PencilPay quickly. In just 20-30 minutes via a Zoom call, we’ll help you start signing up customers, processing payments, and integrating your accounting, inventory, and ERP systems. You’ll have your credit application forms live and your first payment processed efficiently.

We can assist you in setting up PencilPay quickly. In just 20-30 minutes via a Zoom call, we’ll help you start signing up customers, processing payments, and integrating your accounting, inventory, and ERP systems. You’ll have your credit application forms live and your first payment processed efficiently.