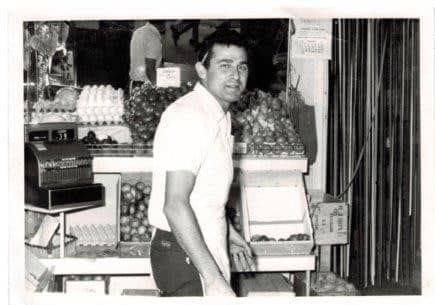

Established in 1963, Scicluna’s is the trusted choice for the highest quality fresh produce for both wholesale and retail customers. Working closely with growers and local suppliers, their approach has always been to carefully select the best quality produce and ensure it is delivered fresh to wholesale customers and retail stores.

Traditional business with modern systems

As part of the modernisation of their business systems, Sciclunas worked with Mark Belkin from Stratus Group to implement MYOB Advanced across all departments, then subsequently included Fresho, an ordering software specialising in fresh produce ordering and replenishment.

This inclusion rounded out a robust ordering and operational tech stack but didn’t address the primary concern for every business: cash flow. Despite Fresho handling payment acceptance for prepaid customers, this only guaranteed payment from a small subset of their customer base, with approximately 80% of their customers operating on payment terms ranging between 7 and 30 days end of month (EOM).

After locating PencilPay in the MYOB advanced App Store, the operations team believed it could address three critical issues; customer onboarding, credit management, and payment processing for customers operating on payment terms.

Sciclunas had opportune timing as this aligned with the onset of the COVID-19 lockdowns, resulting in a significant decline in cash flow and revenue for their food service division, and an increase in grocery and independent supermarket trade.

Collaborating with Sciclunas’ operations team and Stratus Group, PencilPay was swiftly implemented and integrated with MYOB Advanced, while simultaneously training the sales, operations, and accounts teams.

PencilPay ensured that both new and existing customers were properly contracted, including completing a credit application and providing a payment method (credit card or direct debit), to address the growing list of outstanding debtors and ensure prompt payment of all invoices by new customers.

Wholesaling fresh fruit and vegetables differs significantly from many other industries, as customers order frequently and receive invoices for each order. Traditionally, suppliers issue statements at the end of each billing period, expecting payment for all invoices within that period. However, given the nature of fresh produce as a primary expense for venues on a weekly basis, this often results in a substantial accrued amount.

With PencilPay’s automatic billing module, the Scicluna’s team could onboard customers quickly via custom account application forms and securely collect and store bank or credit card details for automatic billing. Practically, this allowed Sciclunas to raise an invoice with 7-day terms on a Monday and automatically charge the stored payment method the following Monday, smoothing out their cash flow over time.

Outcome

This streamlined operations from sales signing up new customers to reconciliation, reducing the time spent onboarding customers, entering data, and manually processing and matching payments by half.

Since implementing PencilPay in 2020, the primary benefit has been economic. The cash cycle has accelerated significantly, total overdue receivables have halved, and average debtor days have decreased by 35%.

Ready to streamline your operations and improve cash flow like Scicluna’s? Book a demo with us today to learn how PencilPay can transform your business.