Building and Construction in Australia are in crisis.

Since the start of the year, builders, developers and trades have been wiped out.

Industry-leading commercial builders like ProBuild and Condev are in liquidation, as are huge home builders like Metricon, Hotondo Homes (Hobart), Home Innovation Builders (Perth) and New Sensation Homes. (NSW)

Their collapse has left houses unfinished, building partially complete and livelihoods lost.

Just this week alone, another four Victorian builders (Langford Jones Homes, Snowdon Developments, Wulfrun Construction and Westernport Constructions) also went into liquidation.

In FY22 in Australia, 3200 companies went bust, of which 28% were in construction.

The alarm bells are ringing.

You may think these issues are confined to the construction industry, but this writer is of the opinion that construction is the ‘canary-in-the-coal-mine’ for other sectors.

Why is this happening?

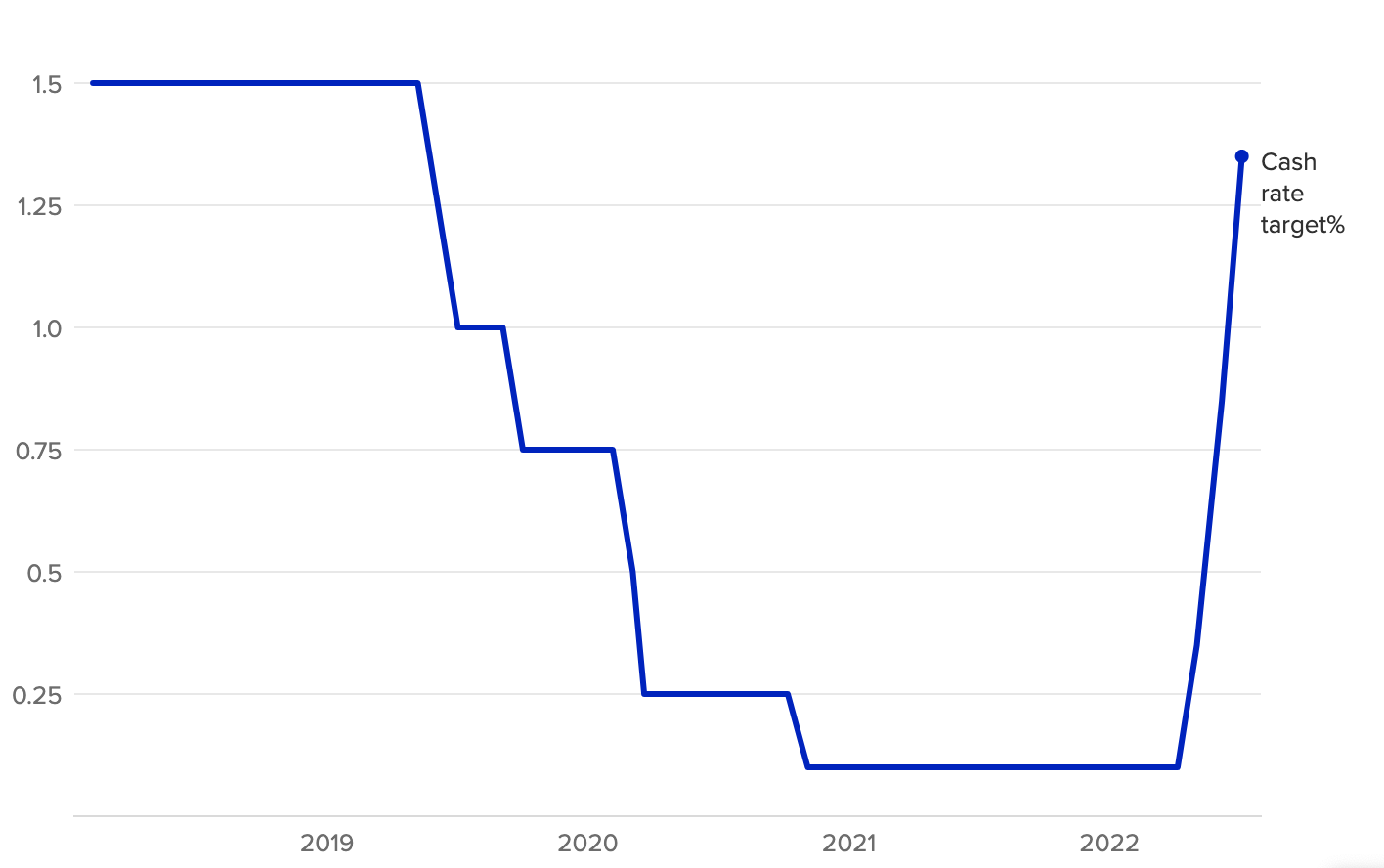

Firstly, the rise in interest rates

Rates have already had a negative effect on the construction industry and the Australian Construction Industry Forum has urged the Reserve Bank to ease off rate hikes, or risk the financial ruin of these companies.

After the 3rd rate rises this year from the RBA, Denita Wawn, from Master Builders Australia, claimed the central bank was now “turning the economic dial too far”.

The interest rate spikes have left millions of Aussie homeowners hundreds of dollars a month worse off, making new potential entrants reconsider the viability of making a purchasing decision.

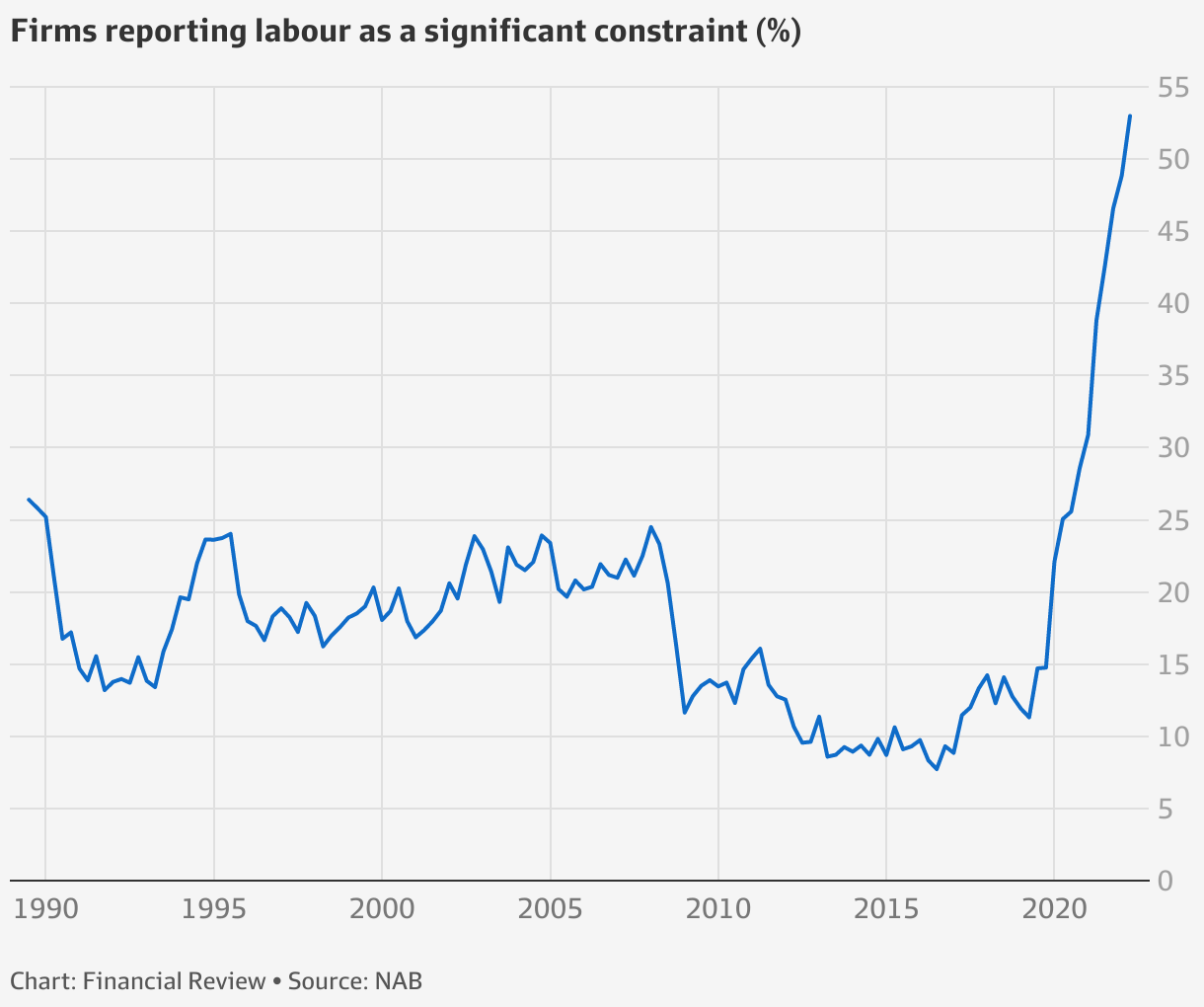

Secondly, Australian businesses are desperate for more workers.

The country is in the middle of one of its largest labour shortages ever.

According to the Australian Bureau of Statistics, there are 423,000+ job vacancies in Australia.

Why?

During the COVID pandemic, state governments shut down what they considered “non-essential businesses” (don’t get me started) and the federal government chose to provide unemployment support for citizens and permanent residents only, leaving international students and workers with little choice.

This drove entry-level workers in retail, hospitality and transport to leave the country, with many never to return.

As you can see in the graph below, this sharp spike has left businesses unable to take on new projects and struggling to complete existing ones.

Thirdly, we have hyperinflation

This has spread from the producer to the consumer for a few reasons.

Time Delays

The delay in sourcing materials from Asia has been extreme. In the second half of 2021, the Chinese Government shut down ports and manufacturing hubs as a ploy to ensure better air quality for the Beijing Winter Olympics in February 2022.

Additionally, in May 2022, lockdowns closed some of China’s major distribution hubs, factories and ports. This caused further bottlenecks on supply.

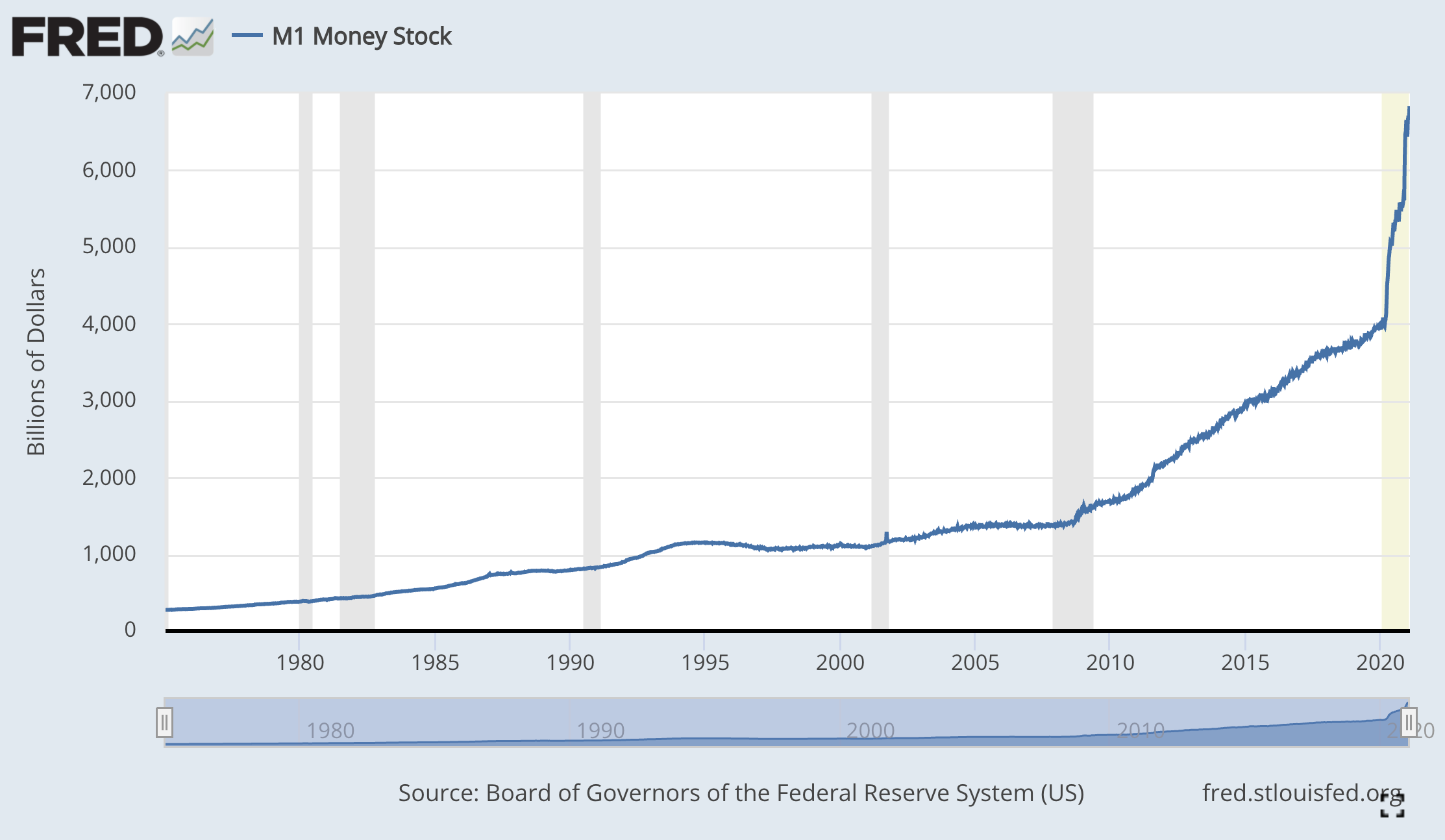

With less supply; comes more demand and nothing drives up demand like the fed printing a boat load of cash. Inflation is caused by too many dollars chasing too few goods and this is a perfect example playing out in front of our eyes.

M1 Money stock in the US

M0 Money Supply (in billions)

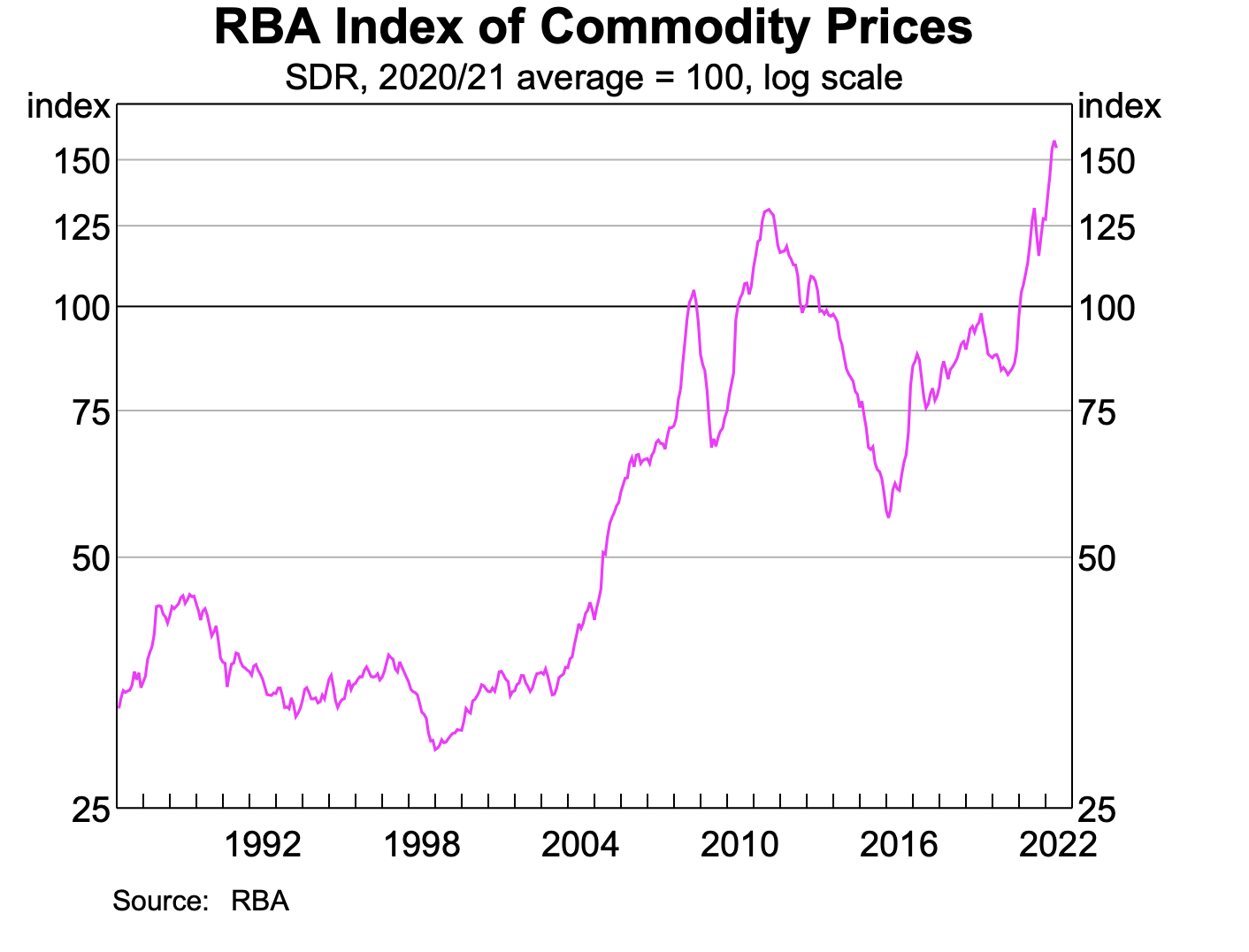

Oil and Gas Prices

There are two wars affecting the price of oil and gas. Obviously, the war in Ukraine is an issue, but more so, the war on the oil and gas industry in the west is the key driver behind the soaring costs of transportation.

The Cost of Energy

Energy prices for manufacturers and factories are growing with no end in sight, due to the economic principle of supply and demand.

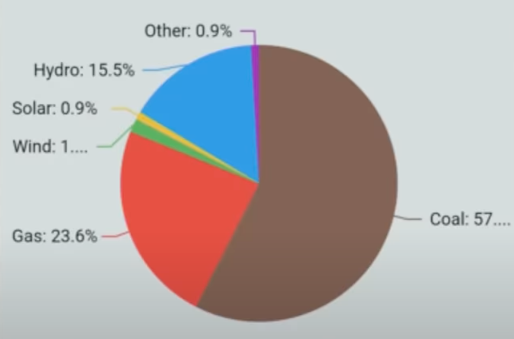

When there is less of something, the price goes up. And this is the case with energy. Coal-fired power stations are being phased out with a greater emphasis on renewables. This may be ok in the future, but in 2022; the technology doesn’t exist.

The chart below shows the power sources used to heat, run and power our businesses and households in Australia on the 17th of June 2022.

In conclusion, these issues have all been driven by state and federal regulation; not the open market.

The result?

More than half of the estimated 12,000 residential construction companies in the country are trading at a loss, with many on the brink of collapse.

The statistics include:

80% who have lost money in the last 12 months.

50% who are currently experiencing negative equity.

30% can’t pay their bills on time.

What does this mean for Suppliers?

Wholesalers, manufacturers and suppliers have faced a rising cost of goods over the last year and it isn’t showing any signs of slowing down. The impacts of the government induced lockdowns have driven up the cost of everything, including raw commodities, packaging and shipping.

According to The Australian Bureau of Statistics, inflation data showed a massive 13.7 per cent increase in transport costs alone, with petrol prices rising at the fastest pace since 1990.

Labour challenges are also effecting the supply chain with transportation problems remaining a source of pain for industry.

Put this all together and goods are more expensive and margins decrease. This shifts the paradigm to 8-10 bad debts causing cashflow issues, to 2-3 bad debts causing cashflow issues. With more pressure at the top of the supply chain, comes increased prices at the consumer level.

They buy less and have less cash flow.

The retailers buy less and have less cash flow.

The impact on product suppliers is obvious; purchasing volume and cash flow.

How can suppliers protect their cash flow?

During these hard economic times, you must stay diligent.

We are seeing a lot of suppliers tighten up their terms and the way they trade.

Here are a few tips to control your cash flow effectively.

Be selective with who you extend credit to

Since the beginning of the pandemic in 2020, more than half (54%) of Australian B2B companies say invoices have been past-due.

Late payments are enough to hinder growth and cause cash flow problems in the future.

As your company takes on new customers during these times, you need to filter out the good payers from the bad before you begin offering your products on payment terms.

When taking on a new customer, make sure you…

Collect an ABN;

Directors information;

Company address;

Get a signed credit agreement;

Perform a credit check

Store a payment method as an extra layer of security

By adding a credit card and/or bank account details on file you can to secure invoice payments a lot more effectively.

When you begin trading with a business you can use the saved payment method to auto charge them on the invoice due date or simply just hold it as security.

Warning: You MUST use a PCI-compliant system to store payment details.

If you’d like PCI-compliant system to onboard new/existing customers with a payment method, book in a time with us and we can give you a quick demo.

Offer support with payment plans

If you have customers with multiple unpaid invoices, look at offering them a payment plan.

During hard economic times, you will see some customers struggling with their invoices. Rather than writing them off complete, a payment plan can help both parties by..

- Making it easier for the customer to pay off smaller increments of debt;

- AND get some money through the door for you

Getting a percentage of payment from your customer can be enough to keep your cash flow going strong while you continue to operate.

However, if they become a repeat offender, you need to have a look at your trading terms.

You can do a prepayment requirement for buyers that pay late in your terms or require a deposit.